- Philosophy

-

Long Term Stable return

- High risk for high return doesn’t comply with clients’ needs.

- Clients’ confidence acquirement as a prudent manager by long term stable return.

- Management

Style -

Growth & Value

- Growth style stocks lead Korean stock market where the growth style company highly contribute to Korean economy.

And as value investment trend extends, the value style stock weight increase. - Therefore, balanced allocation required in mixed situation with growth and value stock. The VI is trying to discover the undervalued stock in early stage by continuous field survey and company analysis.

- Growth style stocks lead Korean stock market where the growth style company highly contribute to Korean economy.

- Management

System -

Sector Manager System based on Bottom-UP approach

- Synergy Maximization : Concentration of capability by sharing each member’s strong point.

- Responsible fund management : Result of research reflect on the management directly.

Research - Driven

- Sector allocation by managers (principal / assistant)

- Field Survey by visiting company more than 4times a week → Report → investment decision making

- Over 2 times seminar a week

Fundamental - Oriented

- The enterprise value is the most important factor in investment decision

- Portfolio set-up : Valuation and stock selection based on mid to long term forecast of industry trend and estimation of each company’s operating result

Set-up balanced portfolio with growth and value style based on sector analysis in charge

Actively react to equity market tends

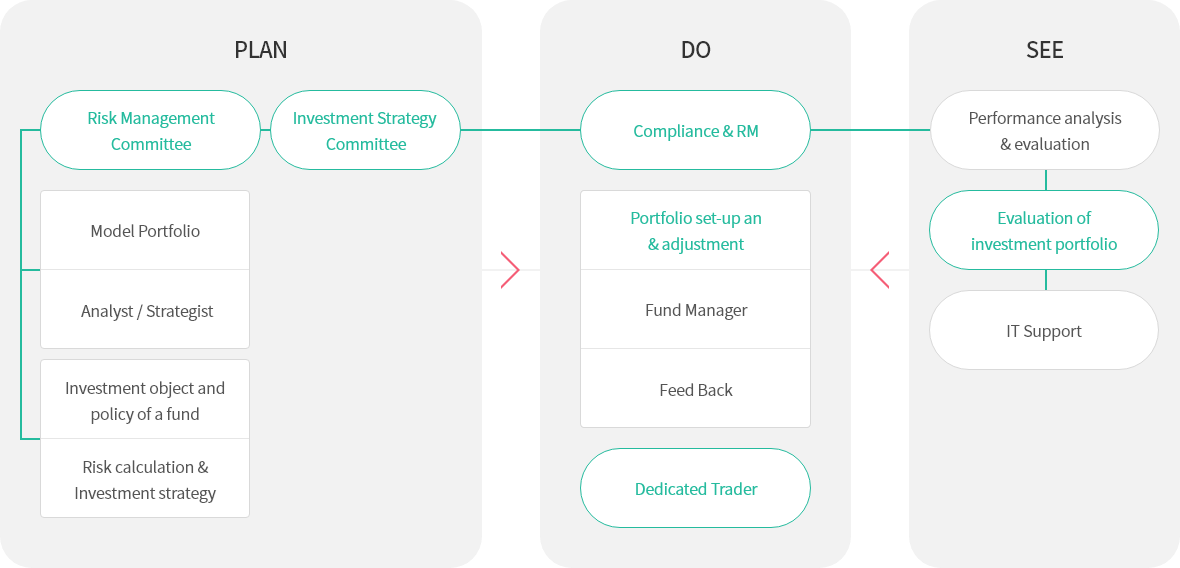

Investment decision making procedure flow chart

Advantage of team based approach

Task procedure flow chart

- Portfolio Concept

- Macroeconomy outlook

- Understanding of domestic investors’ needs

- Discussion of fund characteristics

- Confirmation of fund type & style

- Selection

- Portfolio Design

- Asset Allocation Strategies

- Model Portfolio

- Fund selection

- Portfolio Setup

- Correlation analysis of portfolio Back Testing

- Setting optimal asset allocation

- Portfolio setup

- Implementation of effective exchange risk hedge strategy

- Strategic management considering market trends

- Monitoring

&

Rebalancing - Real time monitoring of portfolio

- Regular analysis & performance evaluation

- Check portfolio management strategy in case of various event